What Is The Depreciation Rate For Tractors . Depreciation covers the decline in the tractor's value over its life. The canada revenue agency (cra) has its. 34 rows ato depreciation rates 2023. Using this method, the company. the model explains 84.2% of the variation in depreciation and provides a significantly better representation of tractor depreciation than. Depreciation expense = $4,500 per year. tractors, like cars, are depreciating assets, so you have to factor in depreciation when you figure out a price. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. If not, you must select a method of depreciation.

from ironsolutions.com

Depreciation covers the decline in the tractor's value over its life. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. 34 rows ato depreciation rates 2023. tractors, like cars, are depreciating assets, so you have to factor in depreciation when you figure out a price. Depreciation expense = $4,500 per year. Using this method, the company. If not, you must select a method of depreciation. The canada revenue agency (cra) has its. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. the model explains 84.2% of the variation in depreciation and provides a significantly better representation of tractor depreciation than.

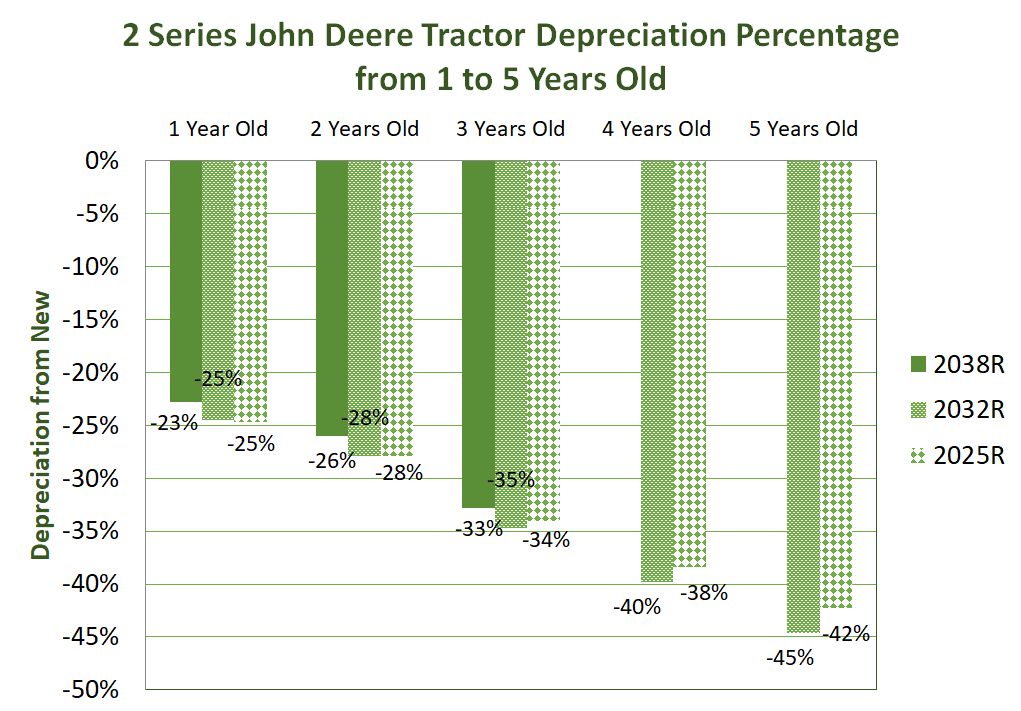

John Deere Compact Tractors Depreciation Analysis Iron Solutions

What Is The Depreciation Rate For Tractors If not, you must select a method of depreciation. If not, you must select a method of depreciation. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. tractors, like cars, are depreciating assets, so you have to factor in depreciation when you figure out a price. Depreciation expense = $4,500 per year. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. 34 rows ato depreciation rates 2023. the model explains 84.2% of the variation in depreciation and provides a significantly better representation of tractor depreciation than. Depreciation covers the decline in the tractor's value over its life. Using this method, the company. The canada revenue agency (cra) has its.

From www.gauthmath.com

Solved Depreciation by two methods A Kubota tractor acquired on What Is The Depreciation Rate For Tractors If not, you must select a method of depreciation. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. tractors, like cars, are depreciating assets, so you have to factor in depreciation when you figure out a price. 34 rows ato depreciation rates 2023. Depreciation expense = $4,500 per year.. What Is The Depreciation Rate For Tractors.

From ironsolutions.com

John Deere Compact Tractors Depreciation Analysis Iron Solutions What Is The Depreciation Rate For Tractors Depreciation expense = $4,500 per year. The canada revenue agency (cra) has its. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. If not, you must select a method of depreciation. the model explains 84.2% of the variation in depreciation and provides a significantly better representation of tractor depreciation than.. What Is The Depreciation Rate For Tractors.

From www.researchgate.net

Depreciation According to Hours Worked 130HP Case Tractor. Download What Is The Depreciation Rate For Tractors 34 rows ato depreciation rates 2023. Depreciation covers the decline in the tractor's value over its life. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. If not, you must select a. What Is The Depreciation Rate For Tractors.

From ironsolutions.com

John Deere Compact Tractors Depreciation Analysis Iron Solutions What Is The Depreciation Rate For Tractors if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. The canada revenue agency (cra) has its. If not, you must select a method of depreciation. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. 34 rows ato depreciation rates 2023. Depreciation. What Is The Depreciation Rate For Tractors.

From www.tractorbynet.com

Expected Depreciation in Used Tractors? What Is The Depreciation Rate For Tractors at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. Using this method, the company. If not, you must select a method of depreciation. 34 rows ato depreciation rates 2023. Depreciation covers the decline in the tractor's value over its life. the model explains 84.2% of the variation in depreciation. What Is The Depreciation Rate For Tractors.

From www.youtube.com

Depreciation and Book Value Calculations YouTube What Is The Depreciation Rate For Tractors 34 rows ato depreciation rates 2023. the model explains 84.2% of the variation in depreciation and provides a significantly better representation of tractor depreciation than. Depreciation covers the decline in the tractor's value over its life. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. tractors, like cars,. What Is The Depreciation Rate For Tractors.

From fitsmallbusiness.com

Rental Property Depreciation How It Works, How to Calculate & More What Is The Depreciation Rate For Tractors Depreciation covers the decline in the tractor's value over its life. If not, you must select a method of depreciation. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. Using this method, the company. 34 rows ato depreciation rates 2023. tractors, like cars, are depreciating assets, so you have. What Is The Depreciation Rate For Tractors.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow What Is The Depreciation Rate For Tractors at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. Depreciation covers the decline in the tractor's value over its life. Depreciation expense = $4,500 per year. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. tractors, like cars, are depreciating assets,. What Is The Depreciation Rate For Tractors.

From wafarmers.org.au

Halve the Depreciation Rate on Farm Machinery to Drive Productivity What Is The Depreciation Rate For Tractors If not, you must select a method of depreciation. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. 34 rows ato depreciation rates 2023. Depreciation expense = $4,500 per year. Using this. What Is The Depreciation Rate For Tractors.

From lakeishaaliha.blogspot.com

Farm equipment depreciation calculator LakeishaAliha What Is The Depreciation Rate For Tractors Depreciation covers the decline in the tractor's value over its life. tractors, like cars, are depreciating assets, so you have to factor in depreciation when you figure out a price. Using this method, the company. If not, you must select a method of depreciation. the model explains 84.2% of the variation in depreciation and provides a significantly better. What Is The Depreciation Rate For Tractors.

From www.researchgate.net

(PDF) Estimating Tractor Depreciation the Impact of Choice of What Is The Depreciation Rate For Tractors if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. Depreciation covers the decline in the tractor's value over its life. tractors, like cars, are depreciating assets, so you have to factor in. What Is The Depreciation Rate For Tractors.

From ironsolutions.com

John Deere Compact Tractors Depreciation Analysis Iron Solutions What Is The Depreciation Rate For Tractors The canada revenue agency (cra) has its. tractors, like cars, are depreciating assets, so you have to factor in depreciation when you figure out a price. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. Using this method, the company. Depreciation expense = $4,500 per year. If not, you must. What Is The Depreciation Rate For Tractors.

From www.chegg.com

Solved Required information [The following information What Is The Depreciation Rate For Tractors The canada revenue agency (cra) has its. Using this method, the company. Depreciation expense = $4,500 per year. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. Depreciation covers the decline in the tractor's value over its life. at a reasonable depreciation rate of 20 per cent that is $20,000. What Is The Depreciation Rate For Tractors.

From willsanellis.blogspot.com

Heavy equipment depreciation calculator WillsanEllis What Is The Depreciation Rate For Tractors Using this method, the company. Depreciation expense = $4,500 per year. tractors, like cars, are depreciating assets, so you have to factor in depreciation when you figure out a price. 34 rows ato depreciation rates 2023. Depreciation covers the decline in the tractor's value over its life. if you qualify for and elect to deduct the whole. What Is The Depreciation Rate For Tractors.

From www.chegg.com

Solved Find the depreciation each year for a tractor that What Is The Depreciation Rate For Tractors if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. 34 rows ato depreciation rates 2023. tractors, like cars, are depreciating assets, so you have to factor in depreciation when you figure out a price. The canada revenue agency (cra) has its. at a reasonable depreciation rate of 20. What Is The Depreciation Rate For Tractors.

From www.chegg.com

Solved Depreciation by Two Methods A Kubota tractor acquired What Is The Depreciation Rate For Tractors Depreciation covers the decline in the tractor's value over its life. Depreciation expense = $4,500 per year. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. Using this method, the company. at a reasonable depreciation rate of 20 per cent that is $20,000 in the first year alone. If not,. What Is The Depreciation Rate For Tractors.

From www.researchgate.net

(PDF) Depreciation Rates for Australian Tractors and Headers Is What Is The Depreciation Rate For Tractors Using this method, the company. 34 rows ato depreciation rates 2023. tractors, like cars, are depreciating assets, so you have to factor in depreciation when you figure out a price. if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. The canada revenue agency (cra) has its. at a. What Is The Depreciation Rate For Tractors.

From www.researchgate.net

(PDF) Estimating Farm Tractor Depreciation Tax Implications What Is The Depreciation Rate For Tractors if you qualify for and elect to deduct the whole tractor under section 179 rules, it's simple. 34 rows ato depreciation rates 2023. The canada revenue agency (cra) has its. If not, you must select a method of depreciation. Using this method, the company. tractors, like cars, are depreciating assets, so you have to factor in depreciation. What Is The Depreciation Rate For Tractors.